Millennials renters not home owners for good reasons, High unemployment, Lower wages, Dropping out of labor force, Living with family, High student debt, White American jobs decimated by Obama economy

“In today’s labor market, there are nearly 1 million “missing” young workers—potential workers who are neither employed nor actively seeking work (and are thus not counted in the unemployment rate) because job opportunities remain so scarce. If these missing workers were in the labor market looking for work, the unemployment rate of workers under age 25 would be 18.1 percent instead of 14.5 percent.”…Economic Policy Institute May 1, 2014

“For now, the absence of young adults from the housing market continues to put a dent in the homeownership rate, which dropped to 64.8% in the first quarter, compared with 65.2% in the fourth quarter of 2013, according to U.S. Census statistics. The rate was as high as 69.2% in the fourth quarter of 2004. For those younger than 35, the rate has fallen noticeably faster. It slipped to 36.2% in the first quarter, from 36.8% in the fourth. The homeownership rate for this group was as high as 43.6% in the second quarter of 2004.”…Market Watch May 12, 2014

“We are being lied to on a scale unimaginable by George Orwell.”…Citizen Wells

Janet Yellen was mystified by millennials’ behaviour.

Apparently so is the media.

From Market Watch May 28, 2015.

“Why ‘Generation Rent’ is reluctant to buy houses”

“The fact that “Generation Rent” — 25- to 34-year-olds in the U.S. — isn’t getting off the fence when it comes to buying homes has been well documented. Even with near record-low interest rates, just 38% of this cohort — also known as millennials — owned homes in 2012, according to CoreLogic, compared with nearly 52% of the same age group in 1980, when mortgage rates were in the double digits.”

“Carrington Mortgage Services, a Santa Ana, Calif.-based mortgage lender and servicer, surveyed millennials about home ownership and then did something unique: it sorted the responses by category, and then broke them out by region in the United States.

What they discovered should make real estate agents and loan officers pay attention, because what’s keeping millennials from buying a home in one part of the country isn’t true in another.”

““Student loan debt is universal,” he said. “What does vary is how significant that becomes to the overall equation.””

Read more:

How about these reasons:

From Citizen Wells March 1, 2015.

“At least 9 million native born Americans being added to the labor force and immigrants taking native born American jobs.

There was an increase of over 12 million not in the labor force since Obama took office.

The youngest members of the workforce, 16 and above will be hit the hardest by immigrant workers.

And all of those jobs that Obama bragged about and Janet Yellen and others referred to….

Of the approx. 6 million new employments since Obama took office in January 2009, 4,511,000 were Hispanic/Latino!

We have barely, if at all, recovered all of the jobs lost during the recession and 75% of the job growth went to Hispanic/Latinos!!””

From Citizen Wells February 25, 2015.

“Janet Yellen: Millennials are a mystery”

“Millennials are a bit of a mystery to Janet Yellen.

The head of the U.S. Federal Reserve said Tuesday that the behavior of millennials — which typically refers to a generation of people born in the 80s and 90s — has top economists scratching their heads.

“I think we’re just beginning to understand how the millennials are behaving,” Yellen said before the Senate Banking Committee. “They’re certainly waiting longer to buy houses; to get married. They have a lot of student debt. They seem quite worried about housing as an investment. They’ve had a tough time in the job market.”

As the economy continues to gain strength, Yellen said she expects more millennials to buy homes and start families. “But,” she quipped, “we’ve yet to really see how this is going to affect that generation.””

“Census Bureau: 30.3% Millennials Still Living With Their Parents”

“From the Economic Policy Institute May 1, 2014.

“This paper’s title, The Class of 2014, is admittedly something of a misnomer, as we do not yet know the labor market outcomes of these soon-to-be graduates. However, the outcomes of recent high school and college graduates provide a good sense of the labor market conditions the young men and women graduating this spring will face. This briefing paper examines the labor market that confronts young graduates who are not enrolled in further schooling—specifically, high school graduates age 17–20 and college graduates age 21–24. We look at young graduates who are not enrolled in further schooling in an attempt to focus as closely as possible on the labor market outcomes of those who are starting their careers. ”

“Key findings include:”

- “In today’s labor market, there are nearly 1 million “missing” young workers—potential workers who are neither employed nor actively seeking work (and are thus not counted in the unemployment rate) because job opportunities remain so scarce. If these missing workers were in the labor market looking for work, the unemployment rate of workers under age 25 would be 18.1 percent instead of 14.5 percent.

- Unemployment and underemployment rates among young graduates are improving but remain substantially higher than before the recession began.

- For young college graduates, the unemployment rate is currently 8.5 percent (compared with 5.5 percent in 2007), and the underemployment rate is 16.8 percent (compared with 9.6 percent in 2007).

- For young high school graduates, the unemployment rate is 22.9 percent (compared with 15.9 percent in 2007), and the underemployment rate is 41.5 percent (compared with 26.8 percent in 2007).

- Overall unemployment rates of young graduates mask substantial disparities in unemployment by race and ethnicity. The unemployment rates of blacks and Hispanics are substantially higher than the unemployment rates of white non-Hispanics, for both young high school graduates and young college graduates.

- The large increases since 2007 in the unemployment and underemployment rates of young college graduates, and in the share of employed young college graduates working in jobs that do not require a college degree, underscore that the current unemployment crisis among young workers did not arise because today’s young adults lack the right education or skills. Rather, it stems from weak demand for goods and services, which makes it unnecessary for employers to significantly ramp up hiring.

- The long-run wage trends for young graduates are bleak, with wages substantially lower today than in 2000. Since 2000, the real (inflation-adjusted) wages of young high school graduates have dropped 10.8 percent, and those of young college graduates have dropped 7.7 percent.

- The erosion of job quality for young graduates is also evident in their declining likelihood of receiving employer-provided health insurance or pensions.

- Graduating in a bad economy has long-lasting economic consequences. For the next 10 to 15 years, those in the Class of 2014 will likely earn less than if they had graduated when job opportunities were plentiful.”

Read more:

http://www.epi.org/publication/class-of-2014/

From Market Watch February 18, 2015.

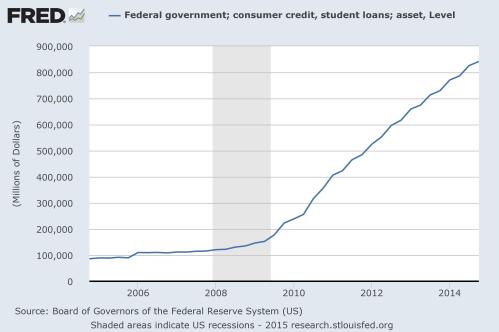

“HIGH STUDENT DEBT EQUALS FEWER HOME BUYERS”

“Going to college usually leads to better jobs and better pay, but it’s also left many people dangerously in debt and unable to buy a house years after they leave school.

A pair of reports in the past two days illustrate the point. The percentage of student loans at least 90 days overdue rose to 11.3% from 11.1% in the final three months of 2014, the New York Federal Reserve said Tuesday.

While delinquencies have fallen from a record 11.8% in 2013, they are still almost twice as high as they were 10 years earlier.

Then on Wednesday the government reported that construction of new homes fell slightly to a 1.06 million annual pace in January. While sales have been rising gradually, they still aren’t increasing nearly as fast as expected almost six years into an recovery. And the percentage of buyers purchasing their first home is still unusually low.

In a fully functioning economy, housing starts should be running around 1.4 million to 1.8 million a year, analysts estimate.

Clearly the weight of student loans is too heavy for many young people to buy a single-family home. Many can’t qualify for a loan in an era of tougher lending standards or afford the monthly cost of a mortgage.””

How about these charts?