Obama Democrats do to US what Obama et al did to IL, Illinois credit rating downgraded, Worst in the nation, Obama Democrats and corruption cronies hurt pensions

“Why did the Illinois Senate Health & Human Services Committee, with Obama as chairman, create and push Bill 1332, “Illinois Health Facilities Planning Act,” early in 2003, which reduced the number of members on the Board from 15 to 9, just prior to rigging by Tony Rezko and Rod Blagojevich?”…Citizen Wells

“Why was Obama promoting Capri Capital and other investment firms at the same time that Rezko, Levine and Cellini were shaking them down?”…Citizen Wells

“I believe I’m more pristine on Rezko than him.”…Rod Blagojevich

From WGN TV January 26, 2013.

“Illinois’ credit rating downgraded; state drops to worst in the nation”

“A warning came Saturday morning from state treasurer Dan Rutherford (R) IL State Treasurer. The Standard and Poor’s downgrade from A to A-minus puts Illinois last on the list– and means a higher cost to borrow money.

On Wednesday, the state will issue $500 million in new bonds to pay for roads and other transportation projects. Rutherford says the credit downgrade will cost taxpayers an additional $95 million in interest,

When compared to a perfect triple-a bond rating enjoyed by other11 states including neighboring Indiana, Iowa and Missouri.

“Our problem in Illinois is that we have not substantively and fairly addressed the state public pension issue.”

Rutherford points to Governor Quinn and the democratically controlled general assembly for making matters worse in the last two years– raising taxes but not acting on pension reform.

“This problem didn’t come along just now it’s been accumulating for actually decades. Each time the governor set a deadline and didn’t meet it there was some negative reaction,” he said.

“It’s become quite evident to me that the general assembly has not registered what these negative impacts are to be enough to cause a change in the public pensions.”

Rutherford says reform should come in the form of new cost of living adjustments and sliding healthcare costs based on pension income, all of which is a hard sell in Springfield– but would put the state back on better financial ground.

“Illinois is a very good place and we can turn this place around– but the first thing we need to do is fix this in a fair way, our public pensions.””

Illinois’ credit rating downgraded; state drops to worst in the nation

From above:

“Rutherford points to Governor Quinn and the democratically controlled general assembly for making matters worse in the last two years– raising taxes but not acting on pension reform.

“This problem didn’t come along just now it’s been accumulating for actually decades. Each time the governor set a deadline and didn’t meet it there was some negative reaction,” he said.”

From Citizen Wells March 29, 2012.

Connecting the dots.

What do Obama and John Glennon have in common aside from associations with Stuart Levine and other Chicago corruption figures?

Involvement with the IL TRS, Teachers Retirement System.

What else do they have in common?

They were both involved with the TRS in 2002 and 2003.

What is significant about these years?

2003: “Of the five funds, the one in the sorriest shape is the Illinois Teacher Retirement System, which provides the pensions for suburban and downstate teachers. Its ratio of assets to liabilities stood at a mere 52 percent last year, so poor that it was considered among the five worst-funded plans in the country.”

From the LA Times April 7, 2008.

In 2002, the year after Obama made the pitch, the Illinois Teacher Retirement System reported an 18% increase in assets managed by minority-owned firms. Ariel’s share grew to $442 million by 2005.

In 2006, after the federal investigation became public, the teacher pension board severed its relationship with Ariel, concluding that Ariel’s investment returns were insufficient.

http://latimesblogs.latimes.com/washington/2008/04/obamarezko.html

From the Common Conservative October 1, 2008.

“On Feb. 10, 2007, Senator Barack Obama launched his bid for the White House in Springfield, setting himself on a course that has become one for the history books. But Obama might not have made it even to the Old State Capitol Building that frigid day if not for a private meeting he had with friends and advisers in late 2002 as he was mulling a run for the U.S. Senate. In a South Side high-rise overlooking the lake, the junior state senator vetted his lofty political ambitions with a group of Chicago’s African American business elite that included Frank M. Clark Jr., Valerie B. Jarrett, Quintin E. Primo III, James Reynolds Jr., and John W. Rogers Jr.”

http://thecommonconservative.com/?p=161

From Citizen News June 15, 2010.

“Today, Tuesday, June 15, 2010, testimony in the Rod Blagojevich trial continues. Joseph Aramanda, with ties to Blagojevich, Rezko and Obama is expected to testify soon.”

“Rezko’s partner in the Rezmar development company, Daniel Mahru, is referred to as “Individual Z” in the indictment, and according to court filings, Rezko told Mahru that “$500 million” of TRS money was earmarked for their company. Mahru is reportedly cooperating with federal investigators.”

“In addition to lining their own pockets, the money gained through the scheme was funneled to the campaigns of Blagojevich and Obama. Prosecutors have identified two $10,000 payments that were made to Obama’s US Senate campaign through straw donors Joseph Aramanda and Elie Maloof, which originated from a kickback paid by investment firm, Glencoe Capital, to secure approval for a $50 million deal.

Aramanda and Maloof also each gave Obama $1,000 for his failed run for Congress in 2000. Once Obama became a US Senator, Aramanda’s son was granted a coveted intern position in Obama’s Senate office in Washington during the summer of 2005, based on a request which the Obama’s camp has admitted came from Rezko.”

Perhaps you have not seen this.

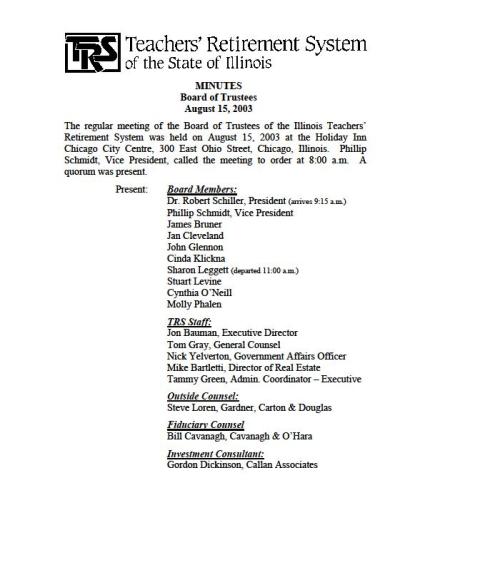

“Glencoe Capital Partners

On a motion by Cynthia O’Neill, seconded by Stuart Levine, it was resolved:

To invest $25 million in Glencoe Capital Partners III, L.P. and invest up to $25 million to Glencoe Capital Institutional Partners III, L.P., subject to the satisfactory completion of contract and fee negotiations. Source of funds will be the TRS Cash Flow account.

Minutes – Board Meeting

August 15, 2003

Page 6

Roll call resulted in affirmative voice votes from Trustees Bruner, Cleveland, Glennon, Klickna, Leggett, Levine, O’Neill, Phalen, and Schmidt. Motion CARRIED.”

For more information about Obama’s impact on the TRS:

“In 2000, after losing a Congressional race, Barack Obama was looking to revive his political fortunes. And he soon found a springboard — a group of black entrepreneurs also trying to break out.

Month after month, Mr. Obama, then an Illinois state senator, showed up at the Chicago group’s meetings, listening to members’ concerns about the difficulties they faced in getting government and corporate business, and asking them what he could do to help.

And help them he did. Members of the group, the Alliance of Business Leaders and Entrepreneurs, say Mr. Obama checked into their problems and helped start a drive that enabled minority investment executives to win millions of dollars in business from the state’s giant pension funds.”

“Mr. Obama also recently pointed to his work on the Illinois pension issue as a model for what he would do as president to promote minority-owned companies.”

Thanks to commenter bob strauss